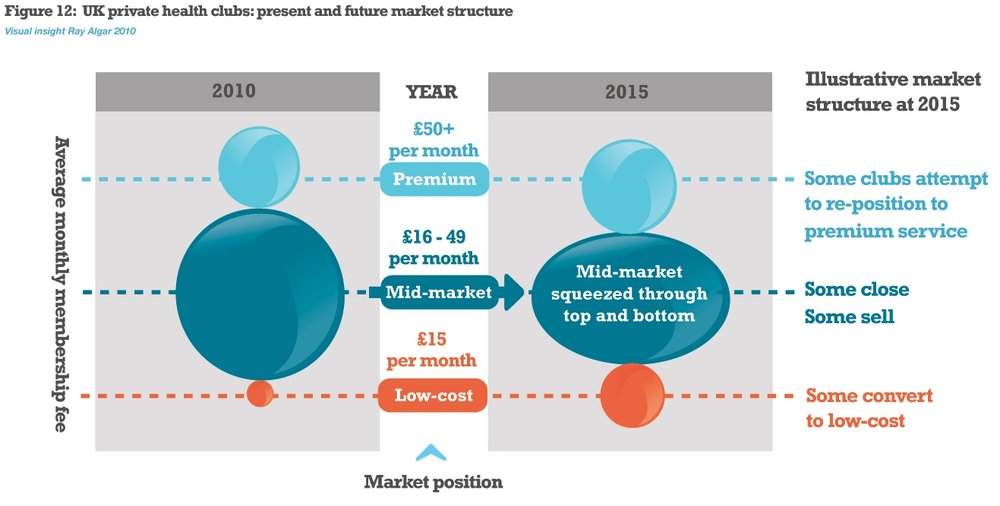

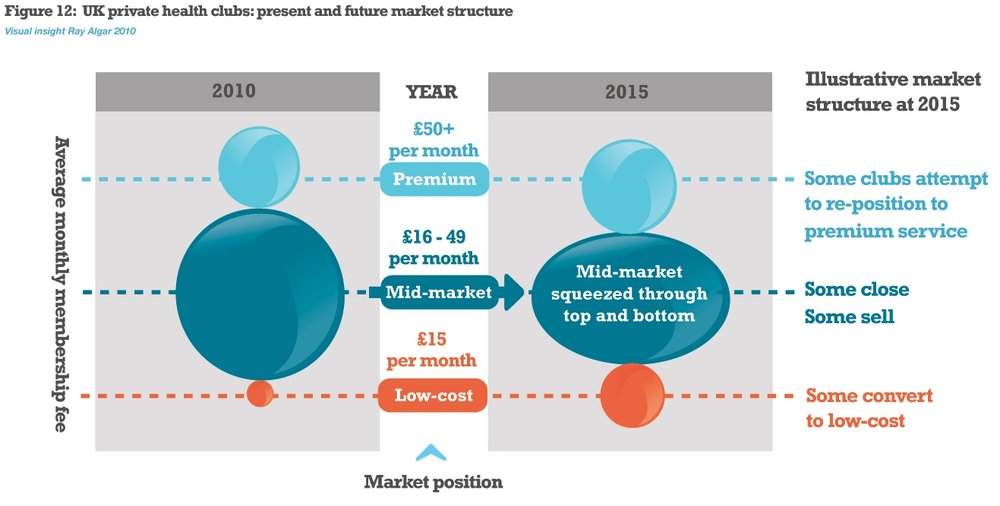

Things are heating up in health club global development and it seems low cost models are making most of the development moves. As Ray Algar's research on the UK market has reflected, there is a squeeze going on in health clubs and it isn't isolated to the UK. Ray's group Oxygen Consulting has some keen insights on this trend.

I recommend you check out Silverstein's book on consumer trends in trading up and trading down. What Algar's graphic above reflects is happening in all consumer markets and its impact on health and fitness is just starting.

I recommend you check out Silverstein's book on consumer trends in trading up and trading down. What Algar's graphic above reflects is happening in all consumer markets and its impact on health and fitness is just starting.

Tell me, Bryan O'Rourke, what do you think of Algar's research and the market Bifurcation trend ? Here is a recap of recent developments in the global health club market.

Europe

Fresh Fitness, a new budget concept, has been launched in Denmark by Rasmus E. Ingerslev, founder of Fitness.dk, with SATS as a co-investor. The new chain offers monthly fees of DKK 99 (€13), reduced costs by excluding all luxury and free services. Many of the fitness classes, such as yoga and spinning, will have no live instructor but will be conducted with the help of video. The company will open the first two fitness centres in Copenhagen, but aims to become the cheapest fitness chain in Denmark.

Budget club operator Pure Gym opened a new site in Smethwick, West Midlands. The new gym will be open to users 24 hours a day, offering users full access for a £15 monthly payment and a £20 joining fee. There are currently six additional sites in the pipeline, with Aberdeen, Belfast and Derby among prospective Pure Gym locations.

United States

Crunch Fitness announced the appointment of Keith Worts, current COO, as its new president. The company also announced that they have started to offer franchise business opportunities as part of their expansion programme. The first franchise is due to open in Autumn 2011 in California and more than 50 franchise locations are also underway in the US and internationally.

Town Sports International released Q2 2010 results, with revenues for Q2 2010 down 5.2% from the same period last year and LFL revenues down 4.2%. Memberships also decreased by 3.8% compared to June 2009. Membership attrition averaged 3.3% per month in Q2 2010 compared to 3.7% per month in Q2 2009. Capital expenditure has been scaled back, with FY 2010 expenditure expected to be $26-28 million, down from $49.3 million spent in 2009.

Asia and Elsewhere

Anytime Fitness announced a number of deals that will see the chain expand into Benelux and Japan, as well as into the UK and Ireland. A master franchise agreement has been signed with Petro Hameleers of the Netherlands, with plans for 150 clubs in Belgium, the Netherlands and Luxembourg over the next 10 years. The company also announced plans to open 300 new clubs in Japan over the next 10 years, where a consortium led by Toru Yamazaki, former CEO of Megalos (the fifth largest health club chain in Japan), has taken on the master franchise. Fast Fitness Japan, will now do business as Anytime Fitness Japan. Anytime Fitness expects to open its 2,000th club by the end of next year.

The énergie Group has appointed Nathan Gardiner as its new general manager for the Middle East. He will relocate from Dubai, where he worked for Fitness First, and will join the énergie team in Doha, Qatar where énergie is currently planning to open a number of clubs. Gardiner started his career in the fitness industry in 2001 with Fitness Exchange. He has also worked for LivingWell Health Clubs and Fitness First.

Evo Fitness Personal Training - an independent, personal training-only facility in Cape Town, South Africa - is scheduled to open this month. Evo Fitness has aligned itself with adidas with an eye to joint involvement in projects going forward.

Australian fitness chain, Genesis Health Clubs, is to open three sites in Sydney. The company, owned by the Melbourne-based Belgravia Group, already owns 38 clubs in Victoria, New South Wales, Queensland, South Australia and Tasmania.

Vivafit, the women-only fitness chain, has signed its first master franchise deal to expand the brand into India. The master franchisee, Manisha Ahlawat, will open the first Indian Vivafit in Delhi in October 2010. The aim is to reach 25 new centres in 2011, and to open more than 1,000 gyms across India over the next 10 years. In the European marketplace, the brand plans to extend its presence to countries such as Italy and Germany.